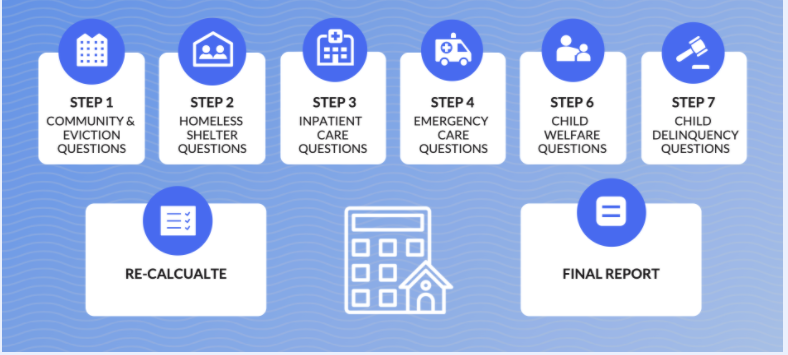

Cost Calculator of an eviction

The I4J Lab at University of Arizona has created a Cost of Eviction Calculator. This tool can help policy-makers, service-providers, and others to determine what the financial cost of an eviction is to their community.

Academic studies of eviction impacts

Abstract

Each year in the U.S., more than two million renter households report being at risk of eviction, yet there is little causal evidence on how evictions affect low-income households. We assemble novel data linking individuals from housing court cases in New York City to administrative data and leverage the random assignment of cases to courtrooms to estimate the causal effect of evictions on homelessness, health, earnings, employment, and public assistance receipt. Evictions cause large and persistent increases in risk of homelessness, elevate long-term residential instability, and increase emergency room use. We find some evidence that evictions lower earnings modestly, but little evidence that they substantially worsen employment outcomes or increase receipt of public assistance. These results suggest that eviction prevention policies could provide important consumption-smoothing benefits to low-income households but are unlikely to substantially reduce poverty on their own.

The Return on Investment of Pandemic Rental Assistance: Modeling a Rare Win-Win-Win, Sam Gilman, Indiana Health Law Review, Vol. 18, 293-354

Abstract

We are facing an eviction crisis. The COVID-19 pandemic has sent our economy into a tailspin, forcing countless Americans to choose between feeding their families or having a roof over their heads. Many low-income people, especially low-income people of color, are facing an unprecedented economic crisis with tremendous rates of wage reductions and job loss. This has resulted in millions of Americans being unable to pay their full rents, creating the legal grounds for their landlords to evict them. Scholars, policymakers, and advocates have increasingly focused on a number of solutions to the eviction crisis (including eviction moratoria and rental assistance), concluding that these solutions can stabilize households, especially when combined. Yet, a counter-narrative almost always offers that investing in national rental assistance programs will be expensive. Indeed, advocates have estimated that more than $100 billion in funding may be needed.

However, few analysts have emphasized the financial costs of inaction. This Article aims to fill that gap by estimating the Return on Investment (“ROI”) of pandemic-related rental assistance programs by comparing the costs of rental assistance with the social costs of homelessness and displacement. As seen in Figure 1, and using end-of-2020 source data, this Article estimates that pandemic rental assistance has a positive ROI of between 208-466%.

These ROI values point to the conclusion that failing to invest in rental assistance will cost dramatically more than making the investment now. The ROI analysis finds that rental assistance stabilizes both tenants and landlords, preserves neighborhoods, and protects government budgets over the long-term. More broadly, the returns on rental assistance argue for a reimagination of the eviction system. The conclusion that the estimated benefits of rental assistance eclipse the estimated costs of providing the funds by three or four times suggests that rental assistance should supplant eviction as the social remedy for the inability to pay rent. With an investment of rental assistance, nonpayment evictions can forever remain “non-essential” evictions. In short, keeping people in their homes during this pandemic and beyond is not only the right thing to, but it is economically the smart thing to do.

Humphries, John Eric, Nicholas Mader, Daniel Tannenbaum, and Winnie van Dijk. “Does Eviction Cause Poverty? Quasi-Experimental Evidence from Cook County, Il.” SSRN Electronic Journal, 2019.

Abstract: Each year, more than two million U.S. households have an eviction case filed against them. Many cities have recently implemented policies aimed at reducing the number of evictions, motivated by research showing strong associations between being evicted and subsequent adverse economic outcomes. Yet it is difficult to determine to what extent those associations represent causal relationships, because eviction itself is likely to be a consequence of adverse life events. This paper addresses that challenge and offers new causal evidence on how eviction affects financial distress, residential mobility, and neighborhood quality. We collect the near-universe of Cook County court records over a period of seventeen years, and link these records to credit bureau and payday loans data. Using this data, we characterize the trajectory of financial strain in the run-up and aftermath of eviction court for both evicted and non-evicted households, finding high levels and striking increases in financial strain in the years before an eviction case is filed. Guided by this descriptive evidence, we employ two approaches to draw causal inference on the effect of eviction. The first takes advantage of the panel data through a difference-in-differences design. The second is an instrumental variables strategy, relying on the fact that court cases are randomly assigned to judges of varying leniency. We find that eviction negatively impacts credit access and durable consumption for several years. However, the effects are small relative to the financial strain experienced by both evicted and non-evicted tenants in the run-up to an eviction filing.